Presented by The PensionmarkMeridien Team, March 6, 2023

THE WEEK ON WALL STREET

A late-week surge, triggered by reassuring Fed-speak, propelled stocks higher last week.

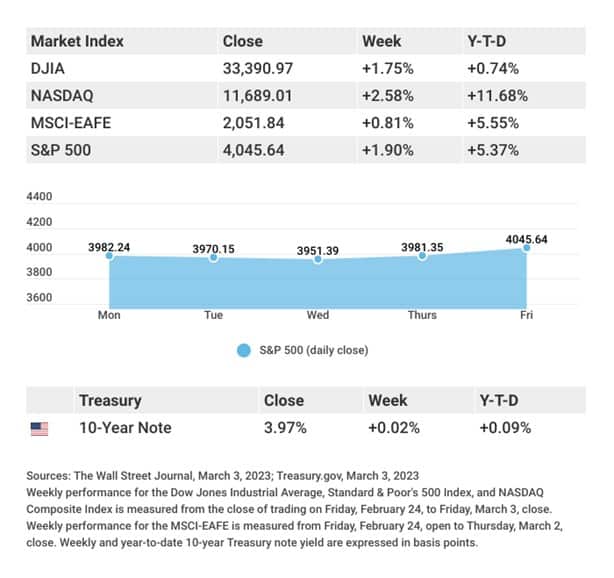

The Dow Jones Industrial Average gained 1.75%, while the Standard & Poor’s 500 advanced 1.90%. The Nasdaq Composite index picked up 2.58% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, added 0.81%. 1,2,3

STOCKS RESUME CLIMB

After rebounding to start the week, stocks weakened following higher inflation numbers out of Europe and higher-than-expected manufacturing activity.

Stocks continued their decline into early Thursday following a report of higher labor costs and low initial jobless claims. But stocks staged an afternoon relief rally on Thursday following comments by Atlanta Fed President Raphael Bostic that he was “still very firmly” supportive of increasing rates in quarter-point increments. The climb in stocks was remarkable, given that yields on 10-year Treasuries reached their highest level since November. Undeterred by a strong services data report, the upside momentum continued into the final trading day and added to the week’s gains.

DISCONCERTING ECONOMIC DATA

It was a relatively quiet week for economic news, but several new economic data reports gave insights into overall activity. U.S. manufacturing activity contracted in February–the fourth consecutive month it has done so. While this may eventually justify a reason for moderating future rate hikes, the activity exceeded analysts’ expectations. An accompanying survey of manufacturers pointed to improving demand and potentially accelerating price pressures.

Meanwhile, China reported an outsized jump in manufacturing activity, which may help relieve remaining supply chain kinks. But the report may also fuel commodity price increases and influence global inflation. Inflation remained a persistent issue in Europe, as February’s Eurozone inflation read was hotter than anticipated.

TIP OF THE WEEK

Take a tip from the millionaire next door: buy a terrific low-maintenance car and drive it for several years or more. Your ride may not be flashy, but the choice may prove thrifty.

THE WEEK: KEY ECONOMIC DATA

Monday: Factory Orders.

Wednesday: Automated Data Processing (ADP) Employment Report. Job Openings and Labor Turnover Survey (JOLTS).

Thursday: Jobless Claims.

Friday: Employment Situation.

Source: Econoday, March 3, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK : COMPANIES REPORTING EARNINGS

Tuesday: Dick’s Sporting Goods, Inc. (DKS), CrowdStrike (CRWD).

Wednesday: MongoDB, Inc. (MDB).

Thursday: Ulta Beauty, Inc. (ULTA), DocuSign (DOCU).

Source: Zacks, March 3, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Your time is limited, so don’t waste it living someone else’s life.”

Steve Jobs

THE WEEKLY RIDDLE

We know that a seahorse isn’t a horse, and we know that a silverfish isn’t a fish. For that matter, a snakehead isn’t a snake – but what is it?

LAST WEEK’S RIDDLE: About 90% of this country’s land area is made up of arid tan desert, yet its flag was once solid green (until 2011) – in fact, at one time it was the only nation in the world with a flag containing just one color. What nation is this?

ANSWER: Libya.

The PensionmarkMeridien Team may be reached at 866-871-9963

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

Pensionmark® Financial Group, LLC (“Pensionmark”) is an investment adviser registered under the Investment Advisers Act of 1940. Pensionmark® is affiliated through common ownership with Pensionmark Securities, LLC (member SIPC).

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2023 FMG Suite.

CITATIONS:

1. The Wall Street Journal, March 3, 2023

2. The Wall Street Journal, March 3, 2023

3. The Wall Street Journal, March 3, 2023

4. CNBC, March 2, 2023

Pensionmark® Financial Group, LLC (“Pensionmark”) is an investment adviser registered under the Investment Advisers Act of 1940. Pensionmark® is affiliated through common ownership with Pensionmark Securities, LLC (member SIPC).