A Review of Q4 2022, Presented by The PensionmarkMeridien Team

THE QUARTER IN BRIEF

The fourth quarter managed to repair some of the damage inflicted on stocks since the beginning of the year. Investor sentiment for much of the quarter rose due to a stronger-than-expected earnings season, a deceleration in inflation, and an increasing conviction that the Fed may begin scaling back on the pace of interest rate hikes. The mood, however, soured in December as recession fears were rekindled by continuing Fed hawkishness and weak economic data, sending stocks lower and paring some of the quarter’s accumulated gains.

October began on a volatile note, as stocks soared in response to Britain’s incoming prime minister’s reversal of an earlier decision to cut taxes, a decision that had sent global markets lower at the end of September. This was soon followed by an extraordinary day in U.S. markets. An above-consensus inflation report sent stocks tumbling in early trading to levels not seen since 2020 before mounting a massive turnaround that by day’s end had witnessed the Dow Jones Industrial Average surging 1,500 points from its midday low. 1

The market stabilized with the start of the third-quarter earnings season, with early earnings reports calming fears of deteriorating profits and pushing Fed policy concerns into the background. Overall, earnings weren’t great, but the bar was low, that most companies exceeded Wall Street’s expectations. With 99% of all S&P 500 companies reporting, 70% of companies checked in with a positive earnings surprise. 2

Stocks added to their gains in November on growing investor optimism for a slowdown in future rate hikes. After the Federal Open Market Committee (FOMC) announced a 75 basis point rate hike at the start of the month, stocks retreated on hawkish comments by Fed Chair Powell in his post-meeting press conference. However, markets staged a quick recovery following a cooler-than-expected inflation number that ignited a rally that lifted stocks to their biggest one-day gain in two years. 3

Despite a stream of comments from multiple Fed officials that discouraged the easing-rate-hike narrative, stocks continued to climb, boosted by upside surprises in new economic data and strong earnings from retailers. Markets received an added boost in November when Powell indicated that a slowdown in rate hikes was appropriate and may begin as early as December.

Stocks opened December by surrendering some of the earlier months’ gains as recession fears dragged on investor sentiment. The Fed announced another rate hike of 50 basis points, widely expected by the market. Still, the increase in the terminal rate (i.e., the rate at which the Fed stops further rate hikes), along with weak economic data, elevated recession worries and closed the quarter and the year on a muted note.

THE U.S. ECONOMY

After two straight quarters of negative growth, the U.S. economy grew by an annualized rate of 2.6% in the third quarter, owing in large part to an outsized contribution from net exports, the biggest in 42 years – a result that appears unlikely to get repeated in future quarters. 4

Most economists are cautious about economic performance in 2023. According to a quarterly survey of professional economic forecasters conducted by the Philadelphia Fed, the consensus points to slowing growth and higher unemployment in 2023. Surveyed forecasters project that the fourth quarter Gross Domestic Product (GDP) annualized growth rate will decline to 1.0%. In the first two quarters of 2023, economists expect growth will flatline (+0.2%). They anticipate a pick-up in the rate of economic expansion in the final two quarters of the year. 5

The U.S. economy feels the effects of higher interest rates, particularly in housing, business investment, and financial assets. At the same time, ongoing inflation continues to undermine the financial health of lower and middle-income Americans.

Consumer confidence, an essential prerequisite to spending, has been declining in recent months as Americans worry about the economy’s health and financial prospects. In The Conference Board’s November survey of consumers, consumer confidence ticked lower, dragged down by inflation and rising interest rates. When asked about their expectations in six months, a growing number of Americans anticipate their incomes will be lower, while a shrinking number of respondents believe their incomes will rise. 6

Yet, despite the consensus of weaker economic growth and the potential for recession in the first half of the new year, there is a case to be made that the economy may fare better than expected.

The U.S. economy remains surprisingly resilient. The labor market has been healthy despite the economic slowdown in 2022, as reflected in the November employment report in which employers added a robust 263,000 jobs, and the unemployment rate stood at 3.7%. One reason for this labor strength may be that employers are hesitant to lay off workers with fresh memories of how difficult it was to hire them coming out of the pandemic. 7

Meanwhile, consumer spending power remains strong, with over $1.5 trillion in aggregate excess savings (savings over pre-pandemic trends), albeit down from its $2.0+ trillion peak in 2021. 8

Finally, The Federal Reserve Bank of Atlanta’s “GDP Now” forecasting model, which attempts to track GDP growth in real-time, estimates an annualized 4Q growth rate of 2.8% (as of December 15, 2022), which stands well above most economists’ expectations. 9

GLOBAL ECONOMIC HEALTH

Global economies continued to be challenged by the conflict between Russia and Ukraine, accelerating inflation, a tightening economic environment, and persistent sluggishness in China. The International Monetary Fund (IMF), in its latest economic forecast, projects that global economic growth in 2022 will come in at 3.2% (unchanged from its earlier July estimate) and slow in 2023 to 2.7% (a downward revision of 0.2 percentage points). The IMF calculates a 25% chance that growth may fall under two percent, with more than a third of economies likely to contract. 10

The IMF has a low outlook for Europe amid high inflation and slowing growth. It projects that advanced economies in Europe will grow by just 0.6% in 2023 while emerging economies (excluding Turkey and conflict countries–Belarus, Russia, and Ukraine) will expand by 1.7%. It anticipates that more than half of Europe’s nations will experience a recession. 11

The outlook for the U.K. is a little better. In the Bank of England’s (BoE) monetary policy report in November 2022, the BoE projected that the nation would be in recession for a prolonged period, with inflation remaining stubbornly high at about 10% until mid-2023. At that time, it may begin to moderate. Any improvement in economic performance may be further out. The BoE estimates that the U.K. economy will shrink by 0.75% in the second half of 2022. They also feel it may continue to contract through 2023 and into the first half of 2024. 12

China’s economy is also struggling, weighed down by persistent lockdowns resulting from its zero tolerance for COVID infections, a policy it only just reversed in December. One independent analysis forecasts that China’s economy will grow by just 3.0% in 2022 and 4.3% in 2023. This is below the government’s 2022 target of 5.5% growth. One notable trouble spot is the downturn in its property sector, which represents at least 20% of the country’s output and nearly two-thirds of urban Chinese household wealth. With the bust in residential prices and new developments, China’s economy may feel the strain of its property issues for years to come. 13

In Japan, the Bank of Japan lowered its forecast of economic growth in 2022 from 2.4% to 2.0%; for 2023, from 2.0% to 1.9%. They raised their estimate for inflation for both years. 14

TIP OF THE QUARTER

If you’re trying to save money or track your spending, consider using cash. Cash is real. You can see it, and you know when you’re out of it. Money becomes more abstract when you use a credit or debit card, leaving you more open to financial choices you may later regret.

LOOKING BACK, LOOKING FORWARD

The rebound in stocks last quarter was primarily a result of moderating inflation, better-than-feared corporate profits, and growing investor relief that the end of the rate hike cycle was closer to the end than the beginning. The fourth quarter also witnessed a change in sector leadership, with the previous market leaders, namely high-growth technology and communication services names, taking a back seat to “old economy” names.

The market’s performance in the year ahead may depend on the same three variables that battered stock prices for much of 2022, i.e., inflation, interest rates, and recession fears.

While these headwinds are not likely to evaporate soon, we may have already seen peak inflation. Should inflation continue to moderate, it may provide the Fed some flexibility with future rate decisions.

But inflation may remain sticky at unacceptably elevated levels. As the Fed learned in the late 1970s, inflation is like toothpaste. Once out of the tube is difficult to put it back.

By its admission, today’s Fed was late to respond to inflation. Moreover, central banks did not defeat the high inflation of the late ’70s/early ’80s alone. Global governments also contributed by reducing fiscal spending, which some politicians seem unwilling to do today, e.g., European subsidies to offset higher energy prices.

Even if inflation moderates, there is no guarantee that the Fed will pivot from its current policy. As Fed Chair Powell has said, the labor market will be one of the critical determinants of future Fed behavior. In the Fed’s mind, strong employment and wage growth add to inflation pressures. Moreover, Powell has repeatedly cautioned about the danger of declaring victory over inflation too soon.

The question for 2023 will be, “Did the Fed go too far?” The economic impact of rate hikes implemented in 2022 may not be evident until early- to mid-2023. Many economists believe the impact of rate hikes will not reveal itself until 9-12 months later. Worries that rate increases result in a recession may weigh heavily on markets, especially in the year’s first half. Investors saw in December what the overhang of a recession could do to stock prices. Whether the economy slips into a recession in 2023 is still open to debate.

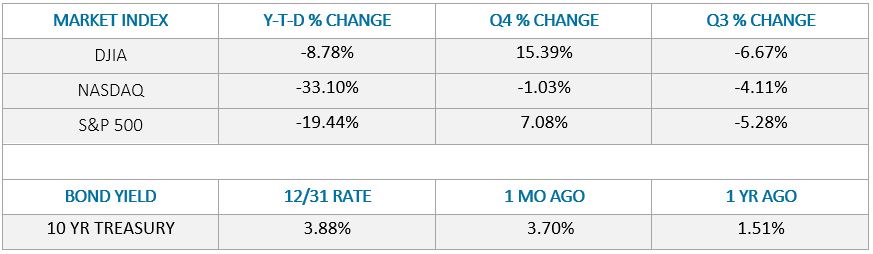

Sources: Wall Street Journal, December 31, 2022, Treasury.gov (Bond Yield)

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid .

QUOTE OF THE QUARTER

“Talent wins games, but teamwork and intelligence win championships.”

MICHAEL JORDAN

The PensionmarkMeridien Team may be reached at 866-871-9963 or meridienteam@pensionmark.com

https://pensionmarkmeridien.com/

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

Pensionmark® Financial Group, LLC (“Pensionmark”) is an investment adviser registered under the Investment Advisers Act of 1940. Pensionmark® is affiliated through common ownership with Pensionmark Securities, LLC (member SIPC).

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2022 FMG Suite.

CITATIONS:

1. CNBC.com, October 13, 2022

2. Factset, December 2, 2022

3. WSJ.com, November 10, 2022

4. Federal Reserve Bank of St. Louis, November 23, 2022

5. Federal Reserve Bank of Philadelphia, November 14, 2022

6. The Conference Board, December 2 1, 2022

7. CNBC, December 2, 2022

8. FederalReserve.gov, October 21, 2022

9. Federal Reserve bank of Atlanta, January 3, 2023

10. International Monetary Fund, October 2022

11. International Monetary Fund, October 23, 2022

12. Bank of England Monetary Policy Report, November 2022

13. piie.com, October 24, 2022

14. Bank of Japan, October 2022

Pensionmark® Financial Group, LLC (“Pensionmark”) is an investment adviser registered under the Investment Advisers Act of 1940. Pensionmark® is affiliated through common ownership with Pensionmark Securities, LLC (member SIPC).