A Review of Q3 2022, Presented by The PensionmarkMeridien Team

U.S. MARKETS

Stocks took investors on a roller coaster ride in the third quarter, with an early summer rally coming to an abrupt end after the Fed pledged to continue fighting inflation.

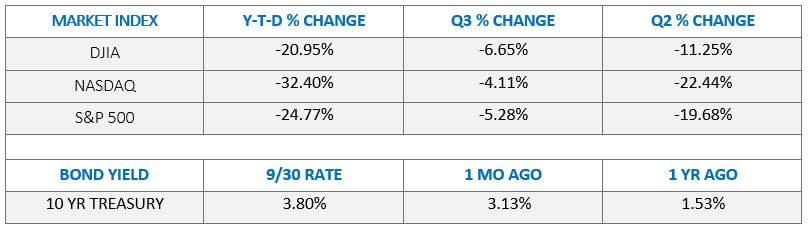

The Dow Jones Industrial Average dropped 6.65 percent during the quarter. The Standard & Poor’s (S&P) 500 Index fell 5.28 percent, while the Nasdaq Composite lost 4.11 percent. 1

A JULY RALLY

After a painful slide from the start of the new year, stocks staged a powerful rally off their mid-June lows.

The summer rally peaked in July as both the S&P 500 Index and the Nasdaq Composite posted strong gains.

The fears of economic weakening that plagued the stock market all year seemed to lessen, even though much of the economic data suggested little had changed.

For example, June inflation came in at 9.1 percent, and many investors anticipated a 100 basis point hike in the federal funds rate after July’s Federal Open Market Committee (FOMC) meeting. 2

POWELL’S AUGUST SPEECH

The upward momentum continued into the first half of August but ended abruptly as rate hike concerns reasserted themselves.

However, Fed Chair Jerome Powell’s hawkish speech at the Jackson Hole Economic Symposium sent stocks lower, returning the market to this year’s general malaise.

ECONOMIC FOCUS IN SEPTEMBER

Stocks saw a brief September upturn but lost momentum ahead of the September 20–21 FOMC meeting, in which the Fed announced its third consecutive 75-basis point hike of the year. 3

Even though markets anticipated the change in interest rates, the Fed’s dim outlook surprised many investors, forcing them to confront the potentially unavoidable scenario of an economic hard landing.

QUARTERLY SECTOR SCORECARD

Many sectors were lower in the third quarter, but Energy (+0.71 percent) bucked the trend. Elsewhere, Communications Services lost 11.76 percent, Consumer Discretionary fell 3.62 percent, and Consumer Staples dropped 7.55 percent.

Meanwhile, Financials dipped 3.47 percent, Health Care slipped 5.56 percent, Industrials declined 5.15 percent, Materials fell 7.60 percent, Real Estate lost 11.87 percent, Technology slipped 6.73 percent, and Utilities dropped 6.59 percent. 4

WHAT INVESTORS MAY BE TALKING ABOUT IN OCTOBER

In mid-October, China’s Communist Party will hold its five-year planning meeting, during which President Xi will most likely be elected to a third term. This meeting will also craft China’s five-year economic framework and foreign policy. 5

The most immediate concern is whether China will maintain its zero-COVID policy, a decision that has slowed economic growth, affected global supply chains, and disaffected its citizens.

Observers will be watching China for any policy statements concerning Taiwan. Even the hint of military action may add further geopolitical risk to the financial markets.

China is an essential cog in the global supply chain and an important market for Western goods. The degree to which it pursues cooperation or confrontation will hold implications for global economies in the years ahead.

WORLD MARKETS

Headwinds to global economic growth continued to build in the third quarter. The International Monetary Fund (IMF) now projects that global economic growth will decelerate to 3.2 percent in 2022 from its earlier estimate of 3.6 percent. 6

China’s zero-COVID policy has continued to slow its economy and strain global supply chains, causing the IMF to lower its estimate of China’s 2022 economic growth to 3.3 percent, the lowest rate in four decades, excluding the COVID pandemic period of 2020. 7

Economic conditions in Europe are also a concern as Eurozone economies remain depressed by accelerating inflation, strained supply chains, the war in Ukraine, and economic slowdowns in China and the U.S.— it’s largest trading partners. 8

Japan’s economy is facing challenges as well, though less acute than in Western economies. The Bank of Japan revised its economic growth projections to be lower due to weakened global economies and continued supply chain constraints. 9

TIP OF THE QUARTER

Your will, trust and powers of attorney should be reviewed regularly, once a year if possible. Time can alter priorities and intentions.

INDICATORS

Gross Domestic Product: The third estimate of second quarter GDP growth was -0.6 percent on an annualized basis. The personal consumption expenditures (PCE) price index was revised higher by 0.2 percentage points to 7.3 percent, indicating continued inflationary pressures. 10

Employment: Employers added 315,000 jobs in August. The unemployment rate rose to 3.7 percent, up from last month’s 3.5 percent level, though the jump was largely attributed to an increase in the labor participation rate, from 62.1 percent to 62.4 percent. Wages continued to grow, rising 0.3 percent in August and 5.2 percent from a year ago. 11

Retail Sales: Retail sales rose 0.3 percent in August, powered by automotive sales. Excluding vehicle-related and gasoline sales, retail sales fell 0.3 percent. 12

Industrial Production: Production in the nation’s factories, mines, and utilities slipped 0.2 percent, though manufacturing output saw a slight increase of 0.1 percent. 13

Housing: Housing starts rose 12.2 percent in August, propelled by a 28.6 percent increase in multi-family housing starts. 14

Existing home sales fell 0.4 percent from July to August and 19.9 percent from a year ago. The median sales price dropped for the second straight month. 15

New home sales climbed 28.8 percent, representing the second biggest increase on record. The median price of new home sales fell from a record high of $458,200 to $436,800. 16

Consumer Price Index: Consumer prices moderated in August as year-over-year inflation rose 8.3 percent, a slight decrease from its 8.5 percent pace in July and down from its recent peak of 9.1 percent in June. However, core prices (excluding food and energy) rose 6.3 percent in August, up from June and July. 17

Durable Goods Orders: For the second-consecutive month, orders of long lasting goods fell, declining 0.2 percent in August. Excluding defense, orders were 0.9 percent lower. 18

THE FED

The FOMC announced its third consecutive 0.75-percent hike in the federal funds rate following its September 20-21 meeting. 19

The FOMC also issued new projections suggesting that interest rates may be increased by another 1.25 percentage points by December. It also said unemployment may rise to 4.4 percent by the end of 2023 (up from August’s 3.7-percent level), and that interest rates may reach as high as 4.6 percent in 2023, with a rate cut unlikely until 2024. 19

Sources: Yahoo Finance, September 30, 2022

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid .

QUOTE OF THE QUARTER

“Talent wins games, but teamwork and intelligence win championships.”

MICHAEL JORDAN

The PensionmarkMeridien Team may be reached at 866-871-9963 or meridienteam@pensionmark.com

https://pensionmarkmeridien.com/

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

Pensionmark® Financial Group, LLC (“Pensionmark”) is an investment adviser registered under the Investment Advisers Act of 1940. Pensionmark® is affiliated through common ownership with Pensionmark Securities, LLC (member SIPC).

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2022 FMG Suite.

CITATIONS:

1. WSJ.com, September 30, 2022

2. CNBC.com, July 13, 2022

3. CNBC.com, September 21, 2022

4. SectorSPDR.com, September 30, 2022

5. Reuters.com, August 30, 2022

6. IMF.org, July 2022

7. IMF.org, July 2022

8. EuropeanCentralBank.eu, September 2022

9. BankofJapan.or.jp, July 2022

10. BEA.gov, September 29, 2022

11. CNBC.com, September 2, 2022

12. WSJ.com, September 15, 2022

13. FederalReserve.gov, September 15, 2022

14. MarketWatch.com, September 20, 2022

15. CNBC.com, September 21, 2022

16. Realtor.com, September 27, 2022

17. WSJ.com, September 13, 2022

18. WSJ.com, September 27, 2022

19. CNBC.com, September 21, 2022

Pensionmark® Financial Group, LLC (“Pensionmark”) is an investment adviser registered under the Investment Advisers Act of 1940. Pensionmark® is affiliated through common ownership with Pensionmark Securities, LLC (member SIPC).